Chinese pharmaceutical enterprise successfully challenged the original drug patent in the United States for the first time

2022-10-20

Source: Today's headline

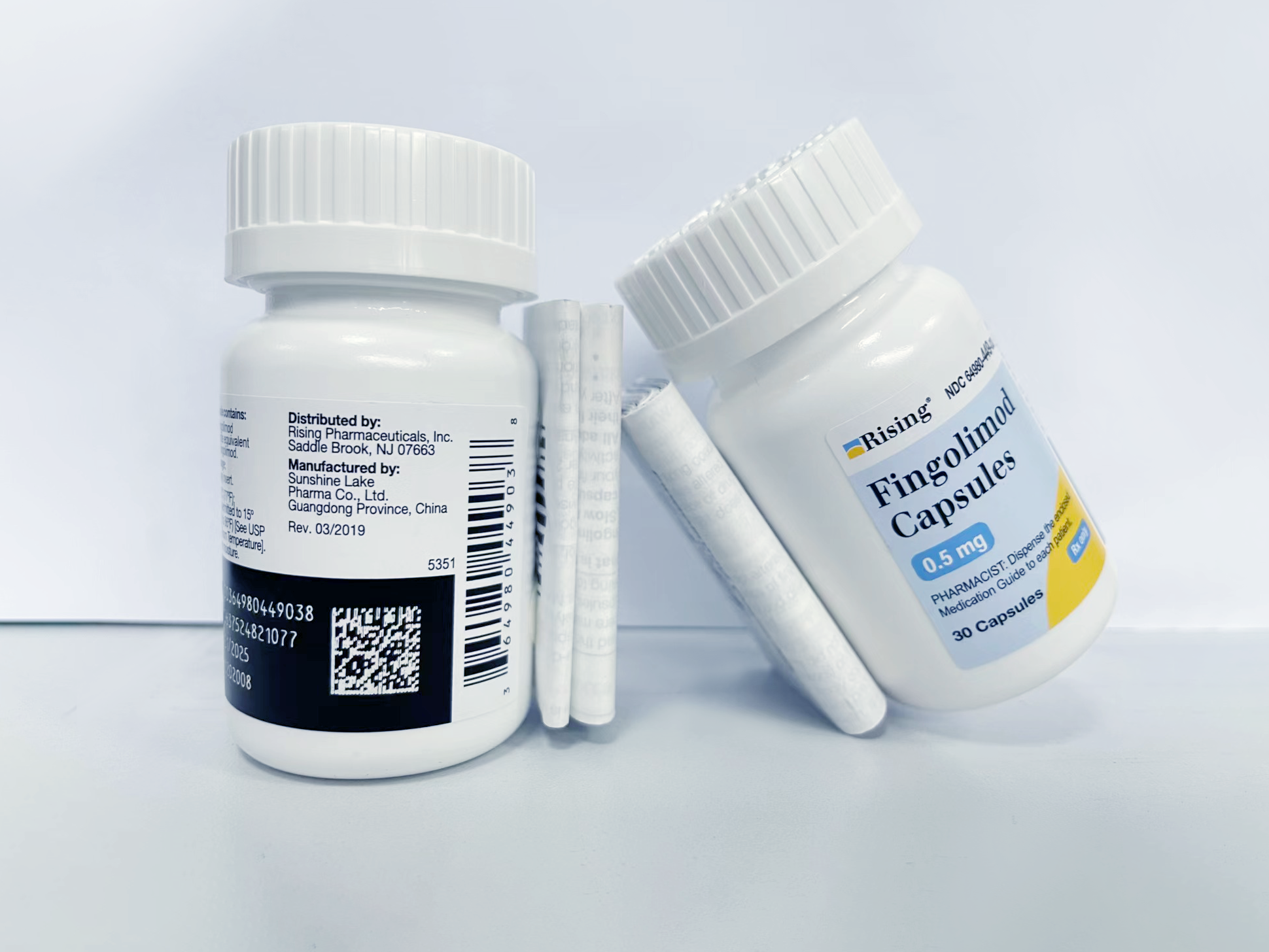

On October 19, HEC Group announced on the WeChat official account that the ’405 patent was officially declared invalid by the American court on October 18, and Sunshine Lake Pharma Co., Ltd. (hereinafter referred to as Sunshine Lake Pharma) has officially been approved to market its first generic drug Fingolimod capsules in the United States.

(HEC production Fingolimod )

As a result, HEC and its generic drug Fingolimod became the first domestic drug to successfully challenge the original drug patent in the United States.

Sunshine Lake Pharma and HEC Pharmaceutical listed in Hong Kong stock market are related parties, both of which belong to HEC Group. Tianyancha shows that HEC Pharmaceutical holds 9.91336% of the shares of Sunshine Lake Pharma, and Sunshine Lake Pharma holds 25.7055% of the shares of HEC Pharmaceutical. In addition, Sunshine Lake Pharma is actively promoting the IPO work, and the valuation of round A in 2021 exceeded 20 billion yuan.

Fingolimod, the first oral drug originally developed by Novartis to treat adult relapsing multiple sclerosis in the world, with the trade name of Gilenya, was approved by the US Food and Drug Administration (FDA) on September 21, 2010, and its peak sales value reached 3.341 billion US dollars in 2018. On July 12, 2019, Novartis Fingolimod was approved by the State Drug Administration to be listed in China.

Multiple sclerosis (MS) is a chronic inflammatory autoimmune disease of the central nervous system. It destroys the communication between the brain and other parts of the body, and is one of the most common causes of neurological disability in adults. It frequently occurs in young and middle-aged people. Women are more common than men. There are about 2.3 million cases worldwide.

However, in November 2018, FDA issued a safety warning to Fingolimod, saying that patients with multiple sclerosis treated with Novartis’ MS drug could become seriously ill or permanently disabled if they stopped taking the drug. Therefore, FDA suggests that patients should be informed of the disability risk of the drug before using Fingolimod, and timely observe the adverse reactions after drug withdrawal.

In fact, Novartis Fingolimod has been facing the onslaught of generic drugs in the American market. Its generic drug rivals include Viatris (a new company formed by Mylan and Pfizer split part), Dr. Reddy’s Laboratories (an Indian generic drug company) and Aurobindo Pharma (an Indian generic drug company). On June 24, 2019, due to the ongoing patent litigation case of Fingolimod, Delaware of the United States issued a temporary injunction. The above-mentioned and other enterprises involved in the generic drug Fingolimod were immediately prohibited from listing related generic drug, which delayed the patent crisis of Novartis Fingolimod for a period of time.

HEC is also one of the patent challengers of Novartis Fingolimod. Different from the aforementioned enterprises, HEC is also the first generic drug enterprise of Fingolimod. HEC submitted the ANDA first generic drug application (i.e., Abbreviated New Drug Application for generic drugs in the United States) to FDA in September 2014 with the accompanying PIV patent declaration (i.e., a statement that the patent related to the applied generic drug is invalid or that the generic drug is not infringing), and then challenged the validity of two Novartis OB (i.e., the list of approved pharmaceutical products that have been evaluated for therapeutic equivalence) patents US5604229 and US8324283.

The above application of HEC for the first generic drug approval is based on the Drug Price Competition and Patent Term Restoration Act issued by the United States on September 24, 1984. According to the provisions of the Act, under the condition that “the patent is invalid or the approval of the drug under application will not infringe the patent”, the first applicant who submits the Abbreviated New Drug Application (ANDA) to FDA will have a 180-day exclusive market period. Within 180 days, generic drug enterprises can quickly recover their investment and establish their position before the market is flooded with other generic drugs.

The exclusive market period has an incentive effect on the R&D of original drug enterprises, and is also of great significance for the first generic drug. According to the exclusive market period, on the first day of the fifth year after the approval of a new drug, that is, four years after the new drug is marketed, generic drug companies can submit the ANDA of the first generic drug they want to FDA. Once the submitted materials are certified and accepted, they will be qualified for the first generic drug. Therefore, since the promulgation of the Drug Price Competition and Patent Term Restoration Act, more and more domestic and foreign pharmaceutical enterprises have made full preparations to join the first generic drug competition in the American market. It is also based on this that HEC can become the first generic drug company of Fingolimod.

After HEC made the patent declaration, Novartis sued HEC with the above-mentioned two patents in February 2015. Among them, the ’283 preparation patent was invalidated by IPR claims from other manufacturers in the process of litigation, and finally the patent was invalid as confirmed by the appeal court. The other ’229 patent is a compound patent with strong stability, which has experienced the first instance and appeal of the district court, and finally reached a settlement by the end of 2017.

In December 2015, Novartis added the newly authorized US9187405 patent (i.e., ’405 patent) to OB, while other manufacturers raised IPR invalidity. In July 2018, the IPR results maintained the validity of the patent, and other companies settled and withdrew from the lawsuit. Only HEC insisted on the trial. On October 18, 2022, the official decision on invalidation of '405 patent was issued. So far, HEC has become the only manufacturer to challenge the Novartis Fingolimod patent to persist to the end and win the lawsuit.

It should be noted that the market for multiple sclerosis is highly competitive. Although HEC first generic drug Fingolimod has been approved to be sold in the United States and has obtained 180 days of market monopoly, it is not certain that HEC will get much share of the overall multiple sclerosis market.

According to Frost & Sullivan data, in 2020, the global market size of multiple sclerosis drugs will be 23.4 billion US dollars, which is expected to grow to 25.7 billion US dollars in 2025, with a compound annual growth rate of 1.9% from 2020 to 2025. According to GBI SOURCE global drug database, Novartis Fingolimod global sales reach 2.79 billion US dollars in 2021. Novartis predicts that once generic drugs are listed, it may lose 300 million US dollars in 2022. As the patent of Fingolimod will expire in 2027, the aforementioned generic drug manufacturers will join the competition, and the market competition of Fingolimod will become more intense. However, the advantage of obtaining the exclusive market period is enough to satisfy HEC.

From the perspective of Novartis, Novartis is one of the leading enterprises in the multiple sclerosis market, but it is not the dominant one. Now, in the multiple sclerosis market, in addition to its original drugs against Biogen, Pfizer, Roche, Merck, Sanofi and other competitors, Novartis will also have to compete with generic drugs to avoid further decline in sales of Fingolimod and avoid following in the footsteps of Biogen.

Biogen was once the absolute king in the field of multiple sclerosis, with rich pipelines, including chemical drugs Tecfidera, immunosuppressant Vumerity, interferon products Avonex and Plegrid, and monoclonal antibody Tysabri. However, Biogen also failed to avoid being encroached by the market share of generic drugs step by step. The financial report for the third quarter of 2022 shows that the sales volume of Tecfidera, its main product of multiple sclerosis, in the third quarter of 2022 was 498 million US dollars, a decrease of 48% over the same period of last year. The most important reason is that many Tecfidera generic pharmaceutical enterprises have entered the American market.

On the contrary, Roche’s monoclonal antibody injection drug Ocrevus is the star in the multiple sclerosis market this year. Ocrevus is known as the most successful product in Roche’s history. The third quarter financial report of 2022 shows that Roche’s quarterly sales of Ocrevus increased by 16% to 1.52 billion Swiss francs.

Read original article:https://www.toutiao.com/article/7156515615035884067/

https://mp.weixin.qq.com/s/kvhBk83voaN7D8Qt6RvMEQ

https://mp.weixin.qq.com/s/yCt2gtzSA2H_zSdZDAcDAw

https://mp.weixin.qq.com/s/U9Zx51Y4TzQkSaDDiKN6Jw

https://mp.weixin.qq.com/s/U9Zx51Y4TzQkSaDDiKN6Jw

https://mp.weixin.qq.com/s/L0p2qLwE1XA_ybLeyk9muw

https://mp.weixin.qq.com/s/RNvDqAxf3aWVEsFVR4H-LA

Related news

WeChat public account

2022 Copyright by HEC Group 粤ICP备19034764号-1